Professional Caulking

Montreal – North Shore – South Shore

Doors and Windows Caulking

Residential – Commercial – Institutional

Specialty: CONDOMINIUMS

ELITE CAULKING

The caulking elite for Doors & Windows in Greater Montreal

Our services

It is the expertise and know-how put into practice by our technicians in their service delivery that allows us to be leaders in our industry, windows and doors caulking in Montreal. Our teams work daily to develop new methods and processes. This is how we can offer you the following services:

Elite Caulking covers the entire Greater Montreal area

Years in business

Successful Projects

Happy Clients

Customer testimonials

Eco-responsibility

Integrity

Regardless of the scope of the work, each project is approached with rigor and a concern for transparency.

Value for money

Our purchasing power with our suppliers allows us to offer the right products at the right price.

The caulking experts for Windows & Doors in Montreal

These phenomena are very often caused by:

– Chemical weakening of sealants already in place

– Movement caused by the expansion and drying of the materials making up the structure of your home.

– Specialist in commercial caulking .

– Experience developed in industrial caulking .

– CAA Quebec Recommended Company

Contact our team

Gallery

Common problems

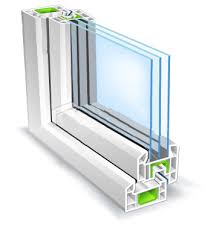

Condensation (fogging) between thermos windows

Cracked, damaged or unsealed glass

Water and air infiltration

Wear and tear of the mechanisms

What must I do?

It is common to observe some failures of the mechanisms as well as a decrease in the energy efficiency of the windows even before they have reached the life promised by the manufacturer.

More and more homeowners are choosing to renovate the windows on their property or building when they show obvious signs of fatigue.